No, it’s also for economic cycles.

Are we in a double dip recession? If so, that would pretty much doom President Barack Obama’s (D-USA) re-election hopes. But still, I hope not.

However, there are several indicators that another recession may be just around the corner, if it’s not the case that we’re already in one.

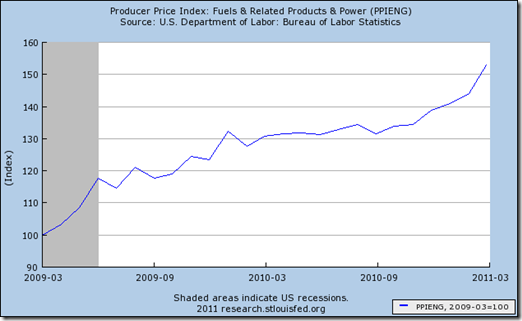

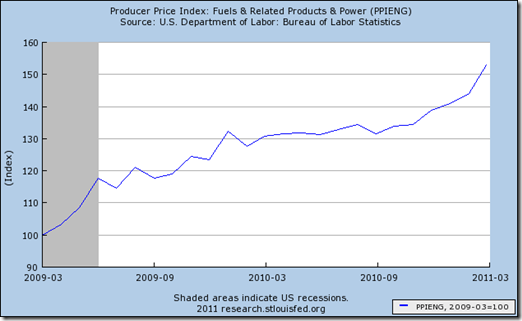

Take a look at this pic:

The lines represent energy prices and the horizontal axis shows a count of months from the start of a recession. The black line represents where we are now. The 0 point is where recessions have been noted to have officially begun. The convergence is artificial as it’s set to 100% at the start of the recession. However, the point worth noting is that we had big rises in energy costs before each recession.

The pic is from a blog called “Early Warning”, and I’ll leave the summary to him:

In every case, energy prices were rising either before or immediately at the onset of the recession, and in every case they "broke" in some sense before the recession was over - either declining, or at least sharply slowing in growth. The paradigm case is 1973 where energy prices were rising steadily and then a huge oil shock coincides with the start of the recession, which only ends after prices have stabilized. However, even in cases like 2001 where most of us would think that energy prices had relatively little to do with the recession, there is a pattern that they were growing rapidly before the recession, and then broke near the start of it.

[…]

If we look at trough to peak change in energy prices in these intervals, the factors are as follows: 1973: 2.0, 1980: 1.9, 1981: 1.7, 1990: 1.6, 2001: 1.9, 2007: 1.6. This is a crude indicator, since in some cases the trough was clearly before the start of my 24 month lead-in, and I didn't go back before that interval.

So, what’s the magic number for 2011? We’re a little over 1.5 as of 03/01/2011. That’s using the 24 months from 03/01/2009.

So, we’re right at the bottom end of an energy price spike that might indicate an impending recession. We could still avoid one at this point, but if energy prices continue to rise, it’s hard to see how we can avoid another recession.

Are energy prices going to rise?

Well…

Based on WTI futures and options prices, the probability that the monthly average price of WTI crude oil will exceed $120 per barrel in December 2011 is about 32 percent. Conversely, the probability that the monthly average December 2011 WTI price will fall below $100 per barrel is about 38 percent.

[…]

EIA expects regular-grade gasoline retail prices, which averaged $2.76 per gallon last summer, will average $3.86 per gallon during the current driving season. The projected monthly average regular retail gasoline price peaks this year at $3.91 per gallon in early summer. Diesel fuel prices, which averaged $2.98 per gallon last summer, are projected to average $4.09 this summer. Weekly and daily national average prices can differ significantly from monthly and seasonal averages, and there is are also significant differences across regions, with monthly average prices in some areas exceeding the national average price by 25 cents per gallon or more.

We hit the $3.90 mark last week, so the EIA projection seems conservative.

But there’s still Natural Gas and Electricity:

U.S. Natural Gas Prices. The Henry Hub spot price averaged $3.97 per MMBtu in March, 12 cents lower than the average price in February and 6 cents lower than the March forecast in last month's Outlook (Henry Hub Natural Gas Price Chart). EIA expects that the Henry Hub price will average $4.10 per MMBtu over 2011, a decline of 29 cents from 2010. However, the projected Henry Hub price rises to $4.55 per MMBtu in 2012.

[…]

During 2010, retail prices for electricity distributed to the residential sector averaged 11.58 cents per kilowatthour, about the same level as in 2009. EIA expects residential prices to rise by 2.3 percent in 2011, followed by little change in 2012.

To sum up, prices are expected to rise throughout the rest of the year, but not much. However, further price increases are expected next year. We may stay just outside a recession right up through next November. Keep an eye on the price of crude and the price of gas. If EIA has been too conservative here, that may be the tipping point.

UPDATE: Changed text to make it more obvious why this is a “W”: double dip recession.

UPDATE: Was asked to recalculate where we are. As of data ending 03-01-2012, we actually look a bit better. For the 24 preceding months the PPIENG is only up about 20%. The warm weather helped create a surplus of natural gas, and kept prices down. We did have a spike in February that I believe continued through March, so we should peek again after the March data is available. But we’re still below where we were last June or so.

The forecasts are that energy prices will hold steady throughout the rest of the year and perhaps even decline a bit, but uncertainty is very high as this graph of expected crude oil prices shows: